Are you thinking of buying a home this summer? If so, you have a great opportunity in front of you. Here are just a few reasons why this season may be the right time to make your purchase.

1. Homeownership Has Many Perks

Homeownership is the American dream –not just because it has tangible financial benefits, but because it also has the power to change lives.

Whether your needs have changed, you’re looking for more stability, or you’re ready to enter a new chapter in your life, turn to homeownership. It provides a safe space to call your own and helps you build your net worth through home price appreciation and home equity. It also gives you a sense of pride and accomplishment throughout your day-to-day life.

2. More Homes Are Expected To Enter the Market This Summer

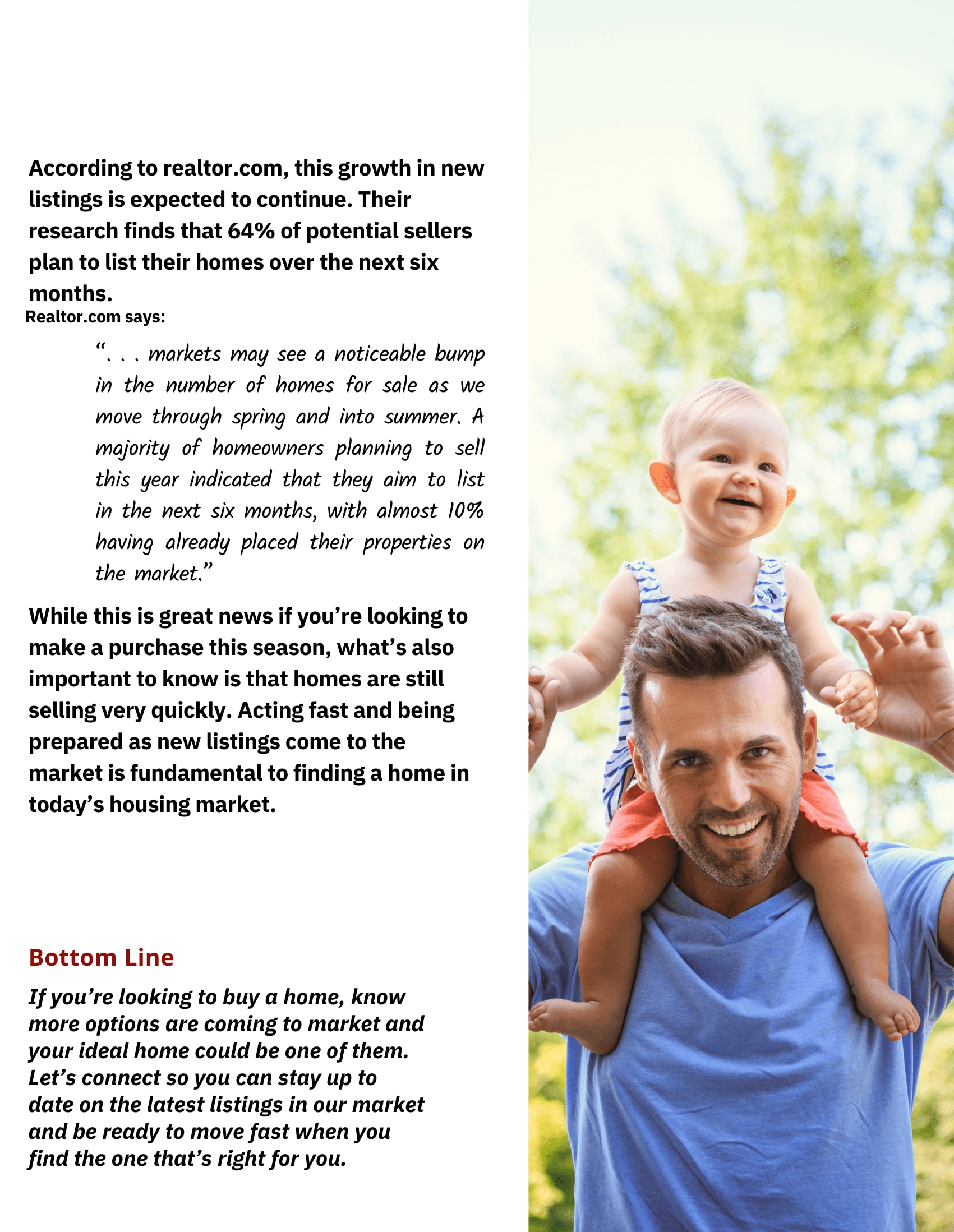

While the number of homes for sale is still lower than pre-pandemic norms, there is good news for your home search. Data from realtor.com shows the number of homes being listed for sale, known in the industry as new listings, has increased since the start of the year. In addition, 64% of sellers plan to list their homes by the end of this summer. That should give you more options.

If you begin your search now and work with a trusted real estate advisor, you’ll be in a great spot to benefit from those additional choices when your dream home hits the market.

3. Home Prices Are Climbing

So far this year, home prices have increased. While competitive buyers are expected to keep home prices climbing, industry leaders say the pace of the increases should moderate moving forward. As Len Kiefer, Deputy Chief Economist at Freddie Mac, says:

“If you’re thinking about waiting until next year and that maybe rates are higher, but you’ll get a deal on prices – well that’s risky. . . .It may be more advantageous to purchase this year relative to waiting until 2023 at this time.”

While everyone moves through the homebuying process at a different pace, it’s more important than ever to put your plans in place and begin working with a real estate advisor. That’s because it’ll cost you more to buy a home if you wait as prices rise.

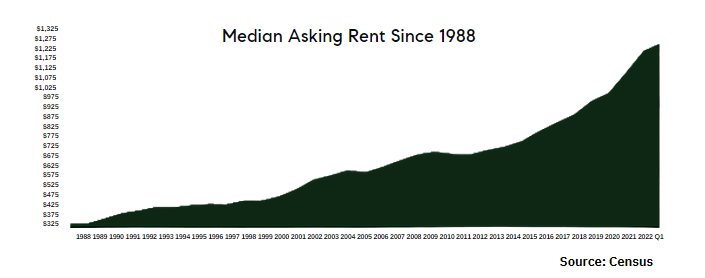

4. Rents Are Rising Too

Census data shows the median monthly rent is also going up (see chart below). To escape rising rents, consider purchasing a home so you can lock in your monthly mortgage payment. Even though the number of homes available for sale is low, homeownership is a much more stable long-term investment

Bottom Line

Let’s connect if you’re ready to learn more about the benefits and rewards of homeownership. Having a local expert on your side is the best way to make your dream a reality this season.

While today’s housing market is competitive for buyers, it’s also a great window of opportunity. If you want to buy a home, here are a few things experts say you should know about what to expect and why homeownership is so important.

The link between financial security and homeownership is undeniable. But your home also provides a sense of gratitude, pride, and comfort. Here are some of the best emotional and financial benefits that come with owning a home.

The Emotional Benefits of Owning a Home Are Powerful

In their list of top reasons to buy a home, the National Association of Realtors (NAR) highlights some of the powerful, non-financial aspects of homeownership. Among them is the opportunity to customize your home to reflect your personality and needs:

“The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.”

Another benefit homeowners enjoy is the stability it provides. Homeowners typically stay put longer than renters. According to NAR, when you remain in one place for more than a few years, you can grow closer to your community, which can enhance your sense of pride and lead to better relationships.

Owninga Home Is a Building Block for Financial Success

The benefits of homeownership extend beyond the emotional too. Owning your home is a cornerstone of achieving financial success. As Leslie Rouda Smith, President of NAR, says:

“Homeownership is rewarding in so many ways and can serve as a vital component in achieving financial stability."

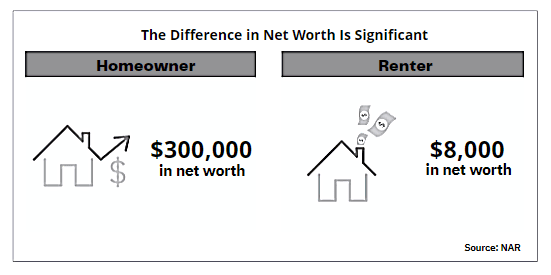

But many people may not realize just how much owning a home contributes to their net worth. A recent NAR report details several homeownership trends and statistics, including the difference in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40X that of a renter.

The gap in net worth exists because as a homeowner, you gain equity as your home appreciates in value and as you pay your mortgage each month. As a renter, you’ll never see a return on the money you pay out in rent every month.

Bottom Line

The benefits of owning a home are foundational. As a homeowner, you can feel proud of the space you call home and know you’ve made a sound financial investment. If you want to learn more about all the ways homeownership can benefit you, let’s connect.

If you’re thinking of buying a home this season, the biggest opportunity you have right now is to get ahead of rising housing costs. Here’s what you need to know.

What’s Happening To Mortgage Rates This Year?

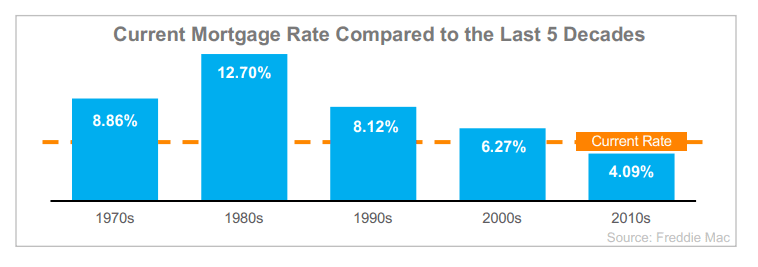

While it’s true the 30-year fixed mortgage rate has climbed over two percentage points this year, just remember that perspective is key. Even though mortgage rates are higher now than they were during the pandemic, they’re still more competitive than historic norms. Mark Fleming, Chief Economist at First American, explains:

“Rising mortgage rates impact affordability, but historical context is important. An average 30-year, fixed mortgage rate of 5.5 percent is still well below the historical average of nearly 8 percent.”

The graph below further illustrates this point. Today you can still lock in a rate that’s comparatively lower than decades past.

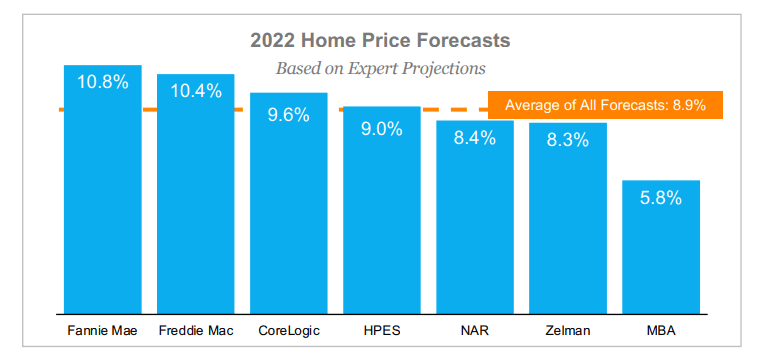

What Will Happen With Home Prices This Year?

In addition, home prices are expected to continue appreciating. The graph below shows the 2022 home price forecasts from seven industry leaders. As the bars indicate, they’re all projecting an increase this year as buyers competing for a limited number of houses continue to put upward pressure on prices. The dotted line represents the average of all the forecasts together, showing the rate of appreciation is expected to be about 8.9%.

While that’s not the record-breaking increase we saw over the past year, its still continued price growth –not a decline. Why is that important to you? If you’re waiting for prices to drop because you think homes will be more affordable, the data from leading experts simply doesn’t support it.

Bottom Line

If you’re ready and able to buy, think of today’s mortgage rates and rising home prices as motivating factors to purchase sooner rather than later. Let’s connect today so you can buy your home before it costs more to do so.

If you’re following the news today, you’re probably hearing about increasing home prices, rising consumer costs, and more. These inflationary concerns might make you wonder if you should wait to buy. Here’s why inflation shouldn’t stop you from purchasing a home this season.

Homeownership Offers Stability and Security

Investopedia explains that during a period of high inflation, prices rise across the board. That’s true for things like food, entertainment, and other goods and services –even housing. Both rental prices and home prices are on the rise. So as a buyer, how can you protect yourself from increasing costs? The answer lies in homeownership. Buying a home allows you to stabilize what’s typically your biggest monthly expense: your housing cost. If you get a fixed-rate mortgage on your home, you lock in your monthly payment for the duration of your loan, often 15 to 30 years. James Royal, Senior Investing and Wealth Management Reporter at , says:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

So even if other prices rise, your housing payment will be a reliable amount that can help keep your budget in check. If you rent, you don’t have that same benefit, and you won’t be protected from rising housing costs.

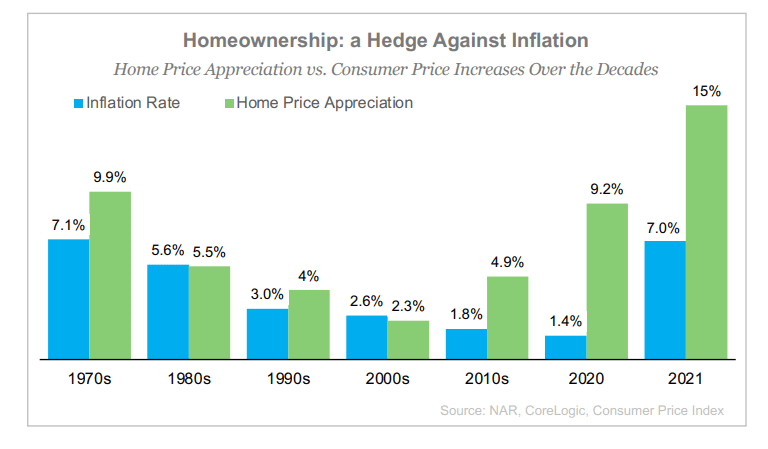

Use Home Price Appreciation To Your Benefit

While it’s true rising home prices mean buying a house today costs more than it did a year ago, you still have an opportunity to set yourself up for a long-term win by locking your payment in at today’s rates and prices.

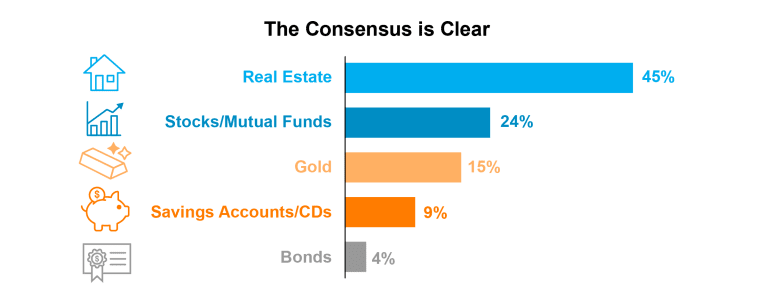

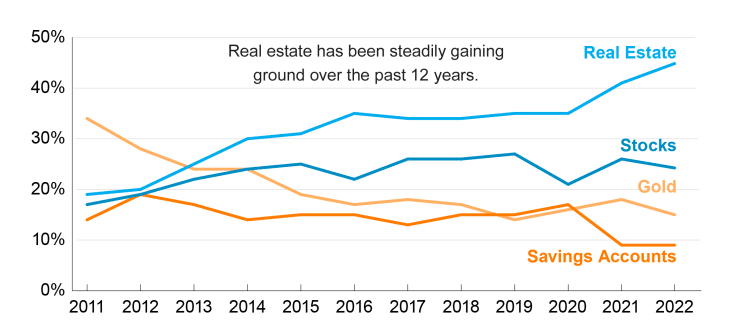

During inflationary times, it’s especially important to invest your money in an asset that will hold or grow in value. The graph below shows how home price appreciation outperformed inflation in most decades going all the way back to the 1970s (see graph below):

So, what does that mean for you? Once you buy a house, any price appreciation that does occur will be good for your equity and your net worth. And since homes are typically assets that grow in value, you have peace of mind that history shows an investment in homeownership is a strong one.

Bottom Line

If you’re ready to buy a home, it may make sense to move forward with your plans despite rising inflation. To make sure you have expert advice on your specific situation and how to time your purchase, let’s connect.

According to a survey from the National Association of Realtors (NAR), one of the top challenges buyers face in today’s housing market is finding a home that meets their needs. That’s largely because the inventory of homes for sale is so low today. But there is hope on the horizon.

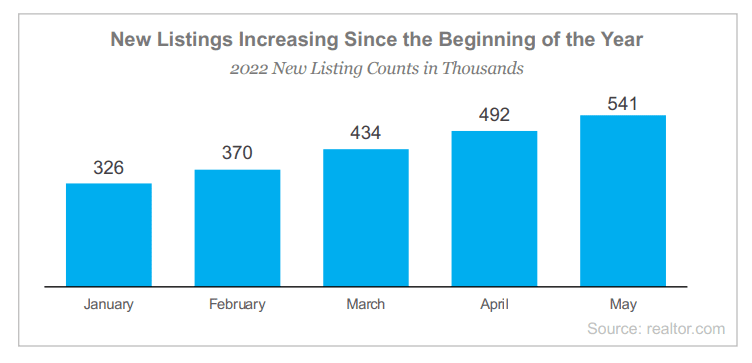

Signs Inventory May Be Growing

Recent data shows more sellers are listing their houses this season, which may give you more options for your home search. The latest from realtor.com shows the number of listings coming onto the market, known in the industry as new listings, has increased since the start of the year (see graph below):

When it comes to buying a home, it can feel a bit intimidating to know how much you need to save and where to find that information. To get you started, here are a few things experts say you should plan for along the way.

Your Down Payment

As you set your savings goal for your purchase, your down payment is likely already top of mind. And like many other people, you may believe you need to set aside 20% of the home’s purchase price for that down payment – but that’s not always the case. The National Association of Realtors (NAR) says:

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership. Having this knowledge is critical to know what to save . . .”

The good news is, you may be able to put as little as 3.5% (or even 0%) down in some situations. To understand your options in today’s market, lean on a professional to go over the various loan types, down payment assistance programs, and what each one requires.

An Earnest Money Deposit (EMD)

While it isn’t required, an earnest money deposit is common in today’s highly competitive market. It’s money you pay as a show of good faith when you make an offer on a house. First American explains how it works:

"This deposit is typically held in trust by a third party and is intended to show the seller you are serious about purchasing their home. Upon closing the money will generally be applied to your down payment or closing costs.”

In other words, an earnest money deposit could be the very first check you’ll write toward your purchase. The amount varies by state and situation, but realtor.com says you can typically plan for 1-2% of the home’s purchase price. Work with a real estate advisor to understand any requirements in your local area and determine if it’s something that could be an option for you.

Your Closing Costs

The next thing to plan for is your closing costs. TheFederal Trade Commission (FTC) defines closing costs as:

“The upfront fees charged in connection with a mortgage loan transaction. . . . generally including, but not limited to a loan origination fee, title examination and insurance, survey, attorney’s fee, and prepaid items, such as escrow deposits for taxes and insurance.”

Basically, your closing costs cover the fees for various people and services involved in your transaction. NAR says to budget for roughly 2-5% of the home’s purchase price. Freddie Mac sums up why this matters to you and your homebuying journey like this:

“If you’re in the market to buy a home, your down payment is probably top of mind. And rightly so – it’s likely the biggest cost of homebuying. However, it is not the only cost and it’s critical you understand all your expenses before diving in. The more prepared you are for your down payment, closing and other costs, the smoother your homebuying journey will be.”

Bottom Line

Knowing what to budget for in the homebuying process is essential. To make sure you understand these and any other expenses that may come up, let’s review your options together.

As a buyer in a sellers’ market, you may feel like you’re stuck between a rock and a hard place, especially when inventory is as low as it is today. When you do find the right home, here are five tips to keep in mind that will help you make the best offer possible.

1. Know Your Budget

Knowing your budget and what you can afford is critical to your success as a homebuyer. The best first step is working with a lender and getting preapproved for a loan. Your pre-approval indicates how much you’re able to borrow for your mortgage.

“By having a pre-approval letter from your lender, you’re telling the seller that you’re a serious buyer, . . . In a true bidding war, your offer will likely get dropped if you don’t already have one.”

2. Be Ready To Move Fast

Speed and the pace of sales are contributing factors to today’s competitive housing market. According to the Existing Home Sales Report from the National Association of Realtors (NAR):

“Eighty-eight percent of homes sold in April 2022 were on the market for less than a month.”

When homes are selling fast, it’s important to stay flexible and be ready to move quickly. A skilled agent will help you put together and submit your best offer as soon as you find the home you want to buy.

3. Lean on a Real Estate Professional

No matter what the housing market looks like, rely on a trusted real estate advisor. As Freddie Mac says:

“The success of your homebuying journey largely depends on the company you keep. . . . Be sure to select experienced, trusted professionals who will help you make informed decisions and avoid any pitfalls.”

Agents are experts in the local real estate market with insight into what’s worked for other buyers in the area and what sellers may be looking for in an offer. Your agent will help you understand how to cater to what a seller needs, so your offer stands out.

4. Make a Strong, but Fair Offer

According to the Realtors Confidence Index from NAR, 61% of properties sold above the list price. That means when you’ve found your dream home, offering below or even at a home’s asking price may not be enough right now.

Lean on your agent to help you understand the market value of the home and recent sales trends in the area so you can craft your best offer.

5. Be a Flexible Negotiator

When putting together an offer, your trusted real estate advisor will help you consider which levers you can pull, including contract contingencies (conditions you set that the seller must meet for the purchase to be finalized). Of course, there are certain contingencies you don’t want to give up, like the home inspection. Freddie Mac explains:

“A home inspection contingency gives you the opportunity to have the entire home you'd like to purchase examined by a professional before you close on your contract. Without this contingency, you could be contracted on a house you can't afford to fix.”

Bottom Line

Today’s competitive landscape makes it more important than ever to make a strong offer on a home. Let’s connect to make sure you rise to the top along the way.

“Homeownership is widely recognized as the leading source of net worth. . . . Housing wealth itself is primarily achieved by price appreciation gains, and the nation has seen home prices accelerate at a record pace during the course of the last decade.”

-The National Association of Realtors (NAR)

John Bathurst

Luxury Real Estate Advisor | Principal | John Bathurst Group | Founding Member | Compass South Bay | DRE# 01977487

Mobile: 310.594.5705

Email: [email protected]

Instagram: https://www.instagram.com/johnbathurstgroup/

Facebook Page: https://www.facebook.com/JohnBathurstGroup

Facebook: https://www.facebook.com/johnhbathurst/

LinkedIn: https://www.linkedin.com/in/johnbathurstgroup/

Pinterest: https://www.pinterest.com/johnbathurstgroup/

Twitter: https://twitter.com/Johnbathurst

YouTube: https://www.youtube.com/channel/UCU8RvUIfAflpho2J2FLFwow

TikTok: https://www.tiktok.com/@johnbathurstgroup?is_from_webapp=1&sender_device=pc

Zillow: https://www.zillow.com/profile/John%20Bathurst

Compass: https://www.compass.com/agents/john-bathurst/

Google Business Profile: https://bit.ly/3ueBS13